Remember the “P. Sherman, 42 Wallaby Way, Sydney.” from Finding Nemo? or ” The cupboard under the Stairs, 4, Privet Drive, Little Whinging, Surrey” from Harry Potter? These iconic locations may be fictional, but the importance of a real, accurate address is undeniable to verify a person’s identity.

Proof of address is a verification measure required by businesses and regulatory bodies to confirm the physical residence of an individual. This requirement is a critical part of the Know Your Customer (KYC) process, which helps companies prevent fraudulent activities, comply with anti-money laundering laws, and ensure that their services are not misused.

In this blog, we’ll cover all the essentials of verifying proof of address including the process, list of acceptable proof of address documents, and best practices to stay compliant. Feel free to jump to a section further down if you need to.

Table of Contents

- What is the address verification process?

- When should businesses verify a user’s address?

- What is Proof of Address (PoA)?

- What are the acceptable Proof of Address documents?

- Challenges in completing Proof of Address verification

- How to validate Proof of Address?

- How to accelerate Proof of Address verification with HyperVerge?

What is the Address Verification Process?

The verification process is a systematic approach used by businesses, government agencies and organizations to validate the residential address of an individual. This process is crucial for companies that need to ensure the authenticity of customer information for billing, legal compliance, or identity fraud prevention.

Address verification, at its core, involves checking the provided address against a reliable database or using documentation to confirm that an individual or business is located at the stated address.

In practice, the address verification process looks like this:

- Collection of Address Data: An individual submits their address details through an online form or application.

- Submission of Proof: The individual provides a document as proof of address, such as a utility bill or bank account statement, often by uploading a digital copy. We’ve provided a list of acceptable proof of address documents below.

- Verification: The company uses software to check the address against postal service records, or manually reviews the documentation to ensure the address matches the one on the official documents.

- Confirmation or Rejection: Once verified, the address is either confirmed, or the individual is asked to provide additional information if there are discrepancies.

When Should Businesses Verify a User’s Address?

Businesses should verify a user’s address to provide proof for the accuracy of customer data and compliance with regulatory requirements. Here are some scenarios where address verifications are crucial:

- Onboarding New Customers: When individuals sign up for a new service, particularly in the banking, financial services, or telecommunications sectors, verifying their address is a standard part of the KYC (Know Your Customer) process.

- Processing Transactions: For any financial transaction, especially those involving credit or large sums of money, it’s important to verify the address to prevent fraud and money laundering.

- Shipping and Delivery: E-commerce businesses must verify addresses to ensure that goods are shipped to the correct location, reducing the risk of lost shipments and fraud.

- Updating Customer Information: If a change of address is reported, businesses should verify the new address to maintain accurate and up-to-date records.

- Regulatory Compliance: Various industries are required by law to conduct due diligence, including address verification, to comply with AML (Anti-Money Laundering) and other regulatory standards.

- Fraud Prevention: In any situation where there is a risk of identity theft or payment fraud, address verification acts as a security measure to protect both the business and the customer.

- Legal Services: For any legal process, it’s essential to verify the address of individuals involved to ensure that all legal notices and documents are properly served.

What is Proof of Address (PoA)?

Proof of Address (PoA) is an official document that verifies the residential address of an individual. It is a key requirement in various administrative and financial processes, serving as a means to confirm that a person resides at the location they claim. This is particularly important for compliance with Know Your Customer (KYC) regulations, preventing fraud, and ensuring accurate delivery of services and goods.

What are the acceptable PoA documents?

The documents typically accepted as proof of physical address must include the individual’s full name and current residential address. They should be recent, usually within the last three to six months, to ensure that they reflect the individual’s most current address. The most commonly accepted PoA documents include:

- Utility bills (water bills, gas, electricity, or phone bills)

- Bank account statements

- Government-issued documents (driver’s licenses, passport verification, tax bills)

- Credit card statement (or legitimate documents from credit bureaus)

- Lease agreement

- Car or home insurance policies

- Mortgage statement

- Letter issued by a public authority (a courthouse)

These documents are widely recognized for their reliability because they are typically issued by trusted financial institutions and contain specific personal information that is difficult to forge.

Challenges in Verifying Proof of Address

The address verification process is not without its challenges. Here are some common issues:

Lack of Clarity

Proof of address documents can sometimes be unclear or contain errors. Mistakes in spelling, incorrect or outdated information, and poor-quality document scans can all contribute to the lack of clarity, making it difficult to verify an address accurately.

Disparity in Proof of Address Document Formats

There is a wide variety of document formats that are considered acceptable for proof of address, and these can vary significantly from one country to another. This disparity can cause issues when businesses operate internationally and need to verify proof of addresses from different jurisdictions.

Lack of Trusted Signatories

Some forms of proof of address, physical documents such as letters from employers or public authorities, rely on the credibility of the signatory. If the signatory is not recognized or trusted by the verifying party, the document may not be accepted.

Language Used is Not Clear or Mixed Up with Another Language

Proof of address documents in a foreign language or those that mix multiple languages can pose a significant challenge. The verifying party may require a certified translation, which can add time and expense to the verification process.

How To Validate Proof of Address

Proof of address process keeps evolving, inching towards a more streamlined and secure system. Here’s how businesses can complete address verification effectively:

The Newer Proof of Address Verification Processes

Modern PoA verification processes often involve digital methods such as Optical Character Recognition (OCR) to scan documents in real-time. This technology, as provided by companies like HyperVerge, can accurately extract information from various document types without manual intervention. Additionally, some verification processes are now pin-secured or OTP-based, especially when pulling information from government databases, adding an extra layer of security and ensuring that the individual has authorized access to their personal information.

Criteria for Proof of Address Documents:

- Must be Recent: The PoA document should be the most current one available, reflecting the latest address of the individual. This is typically a document that is no older than three to six months.

- Correct Format: The document must be in a format that is recognized and accepted by the verifying entity. It should be an original or a certified true copy, not altered or edited post-issuance.

- Mentions Date and Signatory Clearly: A valid PoA document will clearly display the date of issuance and the name and signature of the issuing authority or signatory. This helps in establishing the authenticity of the document.

- Mentions Address Accurately: The address must be detailed and precise, including elements like door or flat number, street address, locality, city, state, and postal or ZIP code.

- Other Languages May Be Accepted, but English Helps: While documents in various languages can be accepted, having the PoA in English can expedite the process, especially if the verification is being done in a country where English is the primary language of business

How to Accelerate Proof of Address Verification with HyperVerge

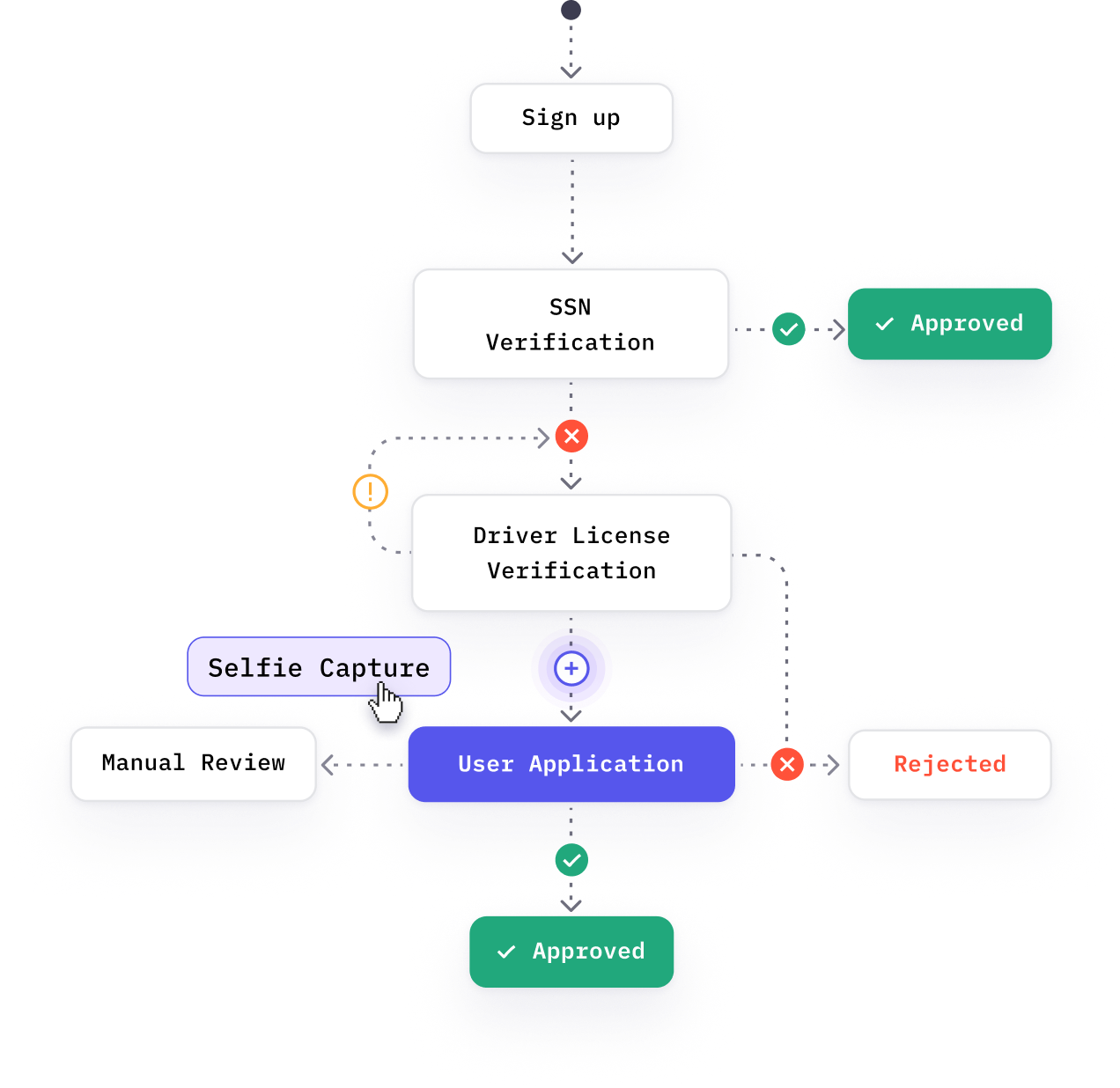

HyperVerge’s OCR technology streamlines the residence address verification process with our ability to quickly scan and extract data from documents in real time. This technology minimizes errors by accurately recognizing and verifying addresses, even across different languages and varying document conditions.

The AI behind HyperVerge’s OCR is continuously trained to ensure top-notch accuracy, reducing the instances of false positives and negatives. For businesses, this means a faster customer onboarding experience, enhanced fraud protection, and a more efficient verification process.

Our no-code workflows have built-in fallback flows that minimize manual reviews and increase auto-approval rates to 95%.

Explore our complete guide to digital identity verification with HyperVerge.

Conclusion

The verification of residence addresses is a cornerstone in the foundation of trust between businesses and their customers. As we’ve explored, the process of proving one’s address is not without its challenges, from ensuring clarity and accuracy to navigating the complexities of international document formats and languages.

Ready for an efficient address verification process? Explore our address verification services and see the difference for yourself or get started with a demo now.