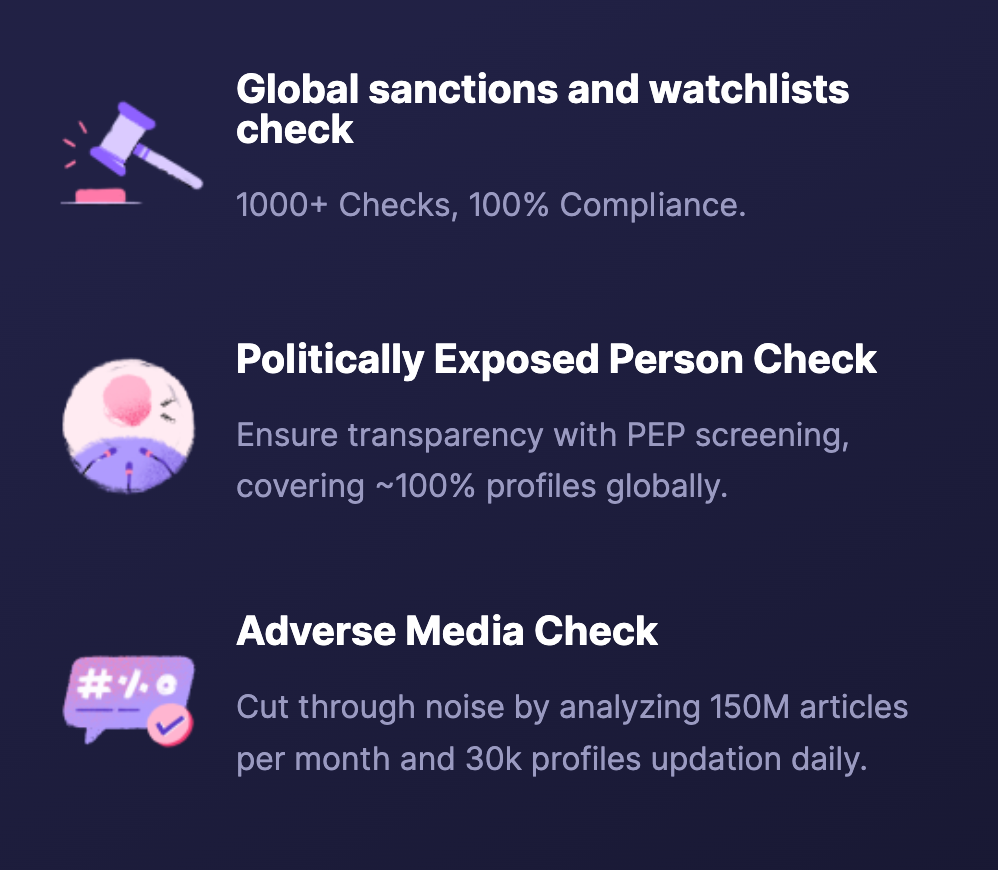

During sanctions screening, financial institutions, legal entities, international bodies, and businesses systematically check their customers’ information or transaction details against lists of sanctioned individuals, entities, or countries.

Sanctions screening helps financial institutions and businesses remain compliant with international sanctions, put a stop to money laundering, disrupt financial crime, avoid penalties, and help protect the national security of the countries in which they operate.

This comprehensive guide will help you understand sanctions compliance and the sanctions screening process with some useful tips and solutions for your business.

Definition of Sanctions Screening

Sanctions screening is the process of systematically checking individuals, entities, and transactions against lists of sanctioned entities, parties, or countries maintained by regulatory authorities. By first screening customers for sanctioned entities, financial institutions and international organizations reduce the likelihood of sanctions breaches, reputational damage, penalties, and legal repercussions associated with sanctions violations.

Sanctions screening challenges often include effective financial sanctions implementation, yet it also contributes to the defense against terrorism financing and drug trafficking and can help prohibit illicit activity.

Why is Sanctions Screening Important?

Sanctions screening works by helping financial institutions and businesses comply with regulatory requirements, mitigate the reputational risk of involvement in illicit activities and financial crimes, safeguard against sanctions violations and terrorist financing, prevent financial crime, and maintain the integrity of the global financial system.

Effective sanctions screening tools help comply with relevant regulations for Anti-Money Laundering (AML) and KYC by detecting financial risks and crimes. It should be performed at several key stages to prevent money laundering and maintain compliance.

The initial risk assessment should be done when onboarding a new customer or partner. Before conducting business transactions, organizations must verify the identities of their clients or partners, especially in the case of politically exposed persons, against sanctions lists.

Types of Sanctions

Sanctions can be categorized into several types based on their purpose and impact, such as economic, diplomatic, military, and more. It plays an important role in our nation states’ foreign relations, maintaining a secure business environment and preventing illegal activities such as combat terrorism financing, money laundering, and other financial crimes.

From an economic perspective, sanctions can divided into the following types of economic sanctions:

Comprehensive Sanctions

Imposing economic, trade, and financial restrictions involves placing limitations on all transactions with a particular country. These restrictions are often implemented due to various reasons, such as concerns over human rights violations, nuclear proliferation, or support for terrorism. Some notable examples of countries facing such sanctions include Iran, Cuba, and Sudan.

Targeted Sanctions

Limiting transactions with specific high-risk individuals, entities, or individuals listed on the Specially Designated Nationals and Blocked Persons (SDN) list maintained by OFAC (Office of Foreign Assets Control). Russia is the best example.

Sectoral Sanctions

Created to restrict the future development of specific sectors within an economy by restricting a specific subset of financial transactions related to those sectors.

What is a Sanction List?

A sanctions list is a publicly available document issued by national or international regulatory authorities. It is updated regularly and contains relevant details of individuals, entities, territories, or countries subject to international law, economic and financial crimes, and other sanctions landscape restrictions.

Here are some examples of common sanctioning bodies and their lists:

- United Nations (UN): This applies to all UN Nation states.

- Office of Foreign Assets Control (OFAC): This applies to all U.S. citizens, those doing business with or within the United States, those connected to the U.S. in any way, and those trading in U.S. currency.

- European Union External Action Service (EU EEAS): The EU maintains its own list of individuals, organizations, and countries that are subject to sanctions under various EU regulations. The EU EEAS sanctions affect all EU citizens and legal entities established within any of the member states.

- The United Kingdom (UK) Sanction List: The UK government maintains its own list of individuals, organizations, and countries that are subject to sanctions under UK law.

In 2022 alone, U.S OFAC’s enforcement penalties hit a record of $42 million. As per recent stats, the country with the most number of sanctions is Russia with 16,587 sanctions. Individuals or entities identified on these sanctions lists may be forbidden or restricted access to financial systems, banned from trade, or subject to other limitations as part of punishing or preventative measures.

How does Sanctions Screening Work?

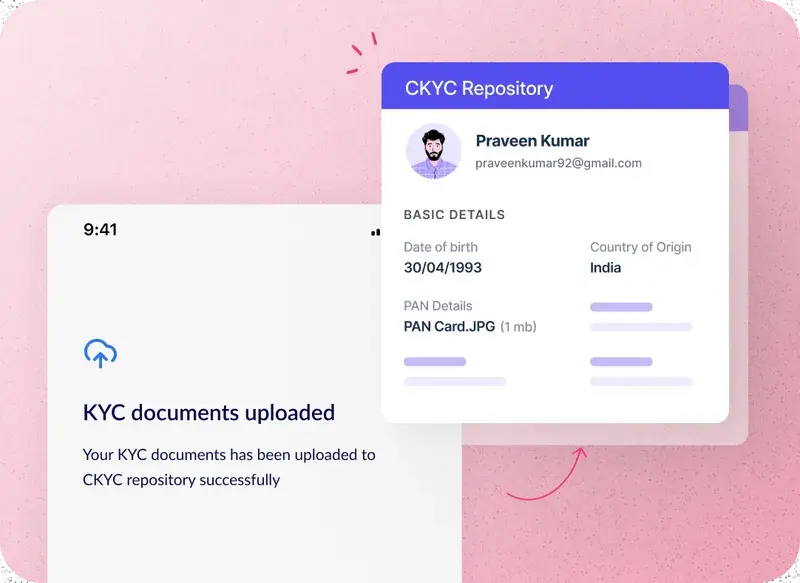

Sanctions screening is an important component of the customer onboarding process for AML and counter-terrorism financing (CTF) programs in the financial industry. The process consists of six crucial steps:

Collecting the data

The initial screening process begins by collecting all necessary data that will be checked against sanctions lists. This could include information about customers, other business relationships, partners, or transactions. Data collection may involve obtaining details such as names, addresses, identification numbers, nationality, date of birth, and transaction amounts.

Validating the data

After collecting all necessary data, it’s crucial to verify its accuracy and identify false positives. This involves cross-referencing the data with other reliable sources, such as ID documents, company registers, or third-party data providers. This verification process is essential for maintaining the integrity of the data before conducting any sanctions screening. Ensuring data accuracy helps risk mitigation and enhances the effectiveness of compliance measures.

Sanction Screening

The validated data is processed through automated sanctions screening software or systems and matched against a global sanctions list, including individuals, organizations, or countries embargoed or sanctioned by regulatory bodies.

The entire process of using sanctions screening technology involves using specialized requirements and software tailored for this purpose. These tools are adept at handling substantial amounts of data and conducting real-time checks with a sanctions list efficiently, ensuring that organizations can effectively screen for sanctioned individuals, entities, or countries in their transactions and operations.

Investigating the results

If a match is found during screening, further analysis is conducted to determine the significance of the match. This involves assessing the level of risk and associated risks along with the match and whether it warrants further investigation or action.

Not all matches against a sanctions list indicate a violation, as there may be legitimate reasons for similarities in names or other data points. This step confirms whether the alerts were false positives or true matches.

Recordkeeping and reporting

Reporting and recordkeeping is the final step in sanctions compliance, which starts only if a true match is found. The institution must file a Suspicious Activity Report (SAR) with the relevant authority or supervisory body.

Non-compliance with reporting obligations carries significant ramifications, extending beyond regulatory sanctions. Institutions risk facing substantial penalties, reputational damage, and potential criminal proceedings for failure to adhere to reporting requirements.

Continuous monitoring

Sanctions screening is an important step, requiring regular monitoring of customers, transactions, and sanctions lists. AML regulations and sanction lists change frequently, so it’s important to monitor regularly. It should be done in real-time or occasionally to verify and ensure compliance with ongoing due diligence obligations.

Tips to Improve the Sanctions Screening Process

- Keep customer data updated and thorough through due diligence: Make sure you have accurate and complete customer information by doing thorough checks and investigations through Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) processes.

- Screen using reliable sanction data: When you’re checking individuals or entities against sanction lists, make sure that the lists you’re using are reliable and trustworthy.

- Use reliable and proven screening technology: Use technology or software that has been tested and proven to be effective in identifying matches against sanction lists.

- Stay updated with rapidly changing sanction lists: Since sanction lists can change frequently, it’s important to stay informed about any updates or additions to ensure that your screening process remains accurate and up-to-date.

Make Your Sanction Screening Process Seamless and Efficient

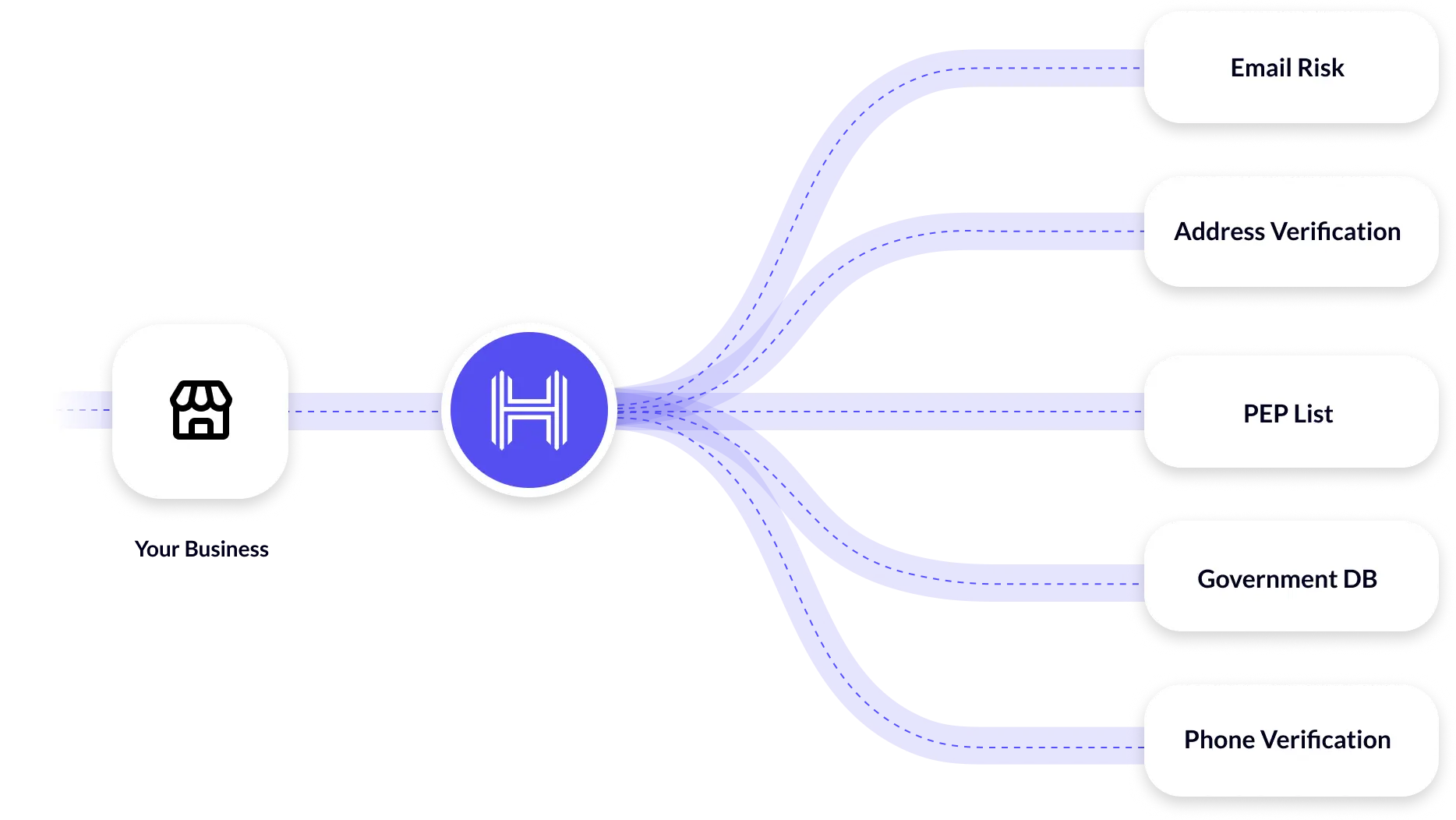

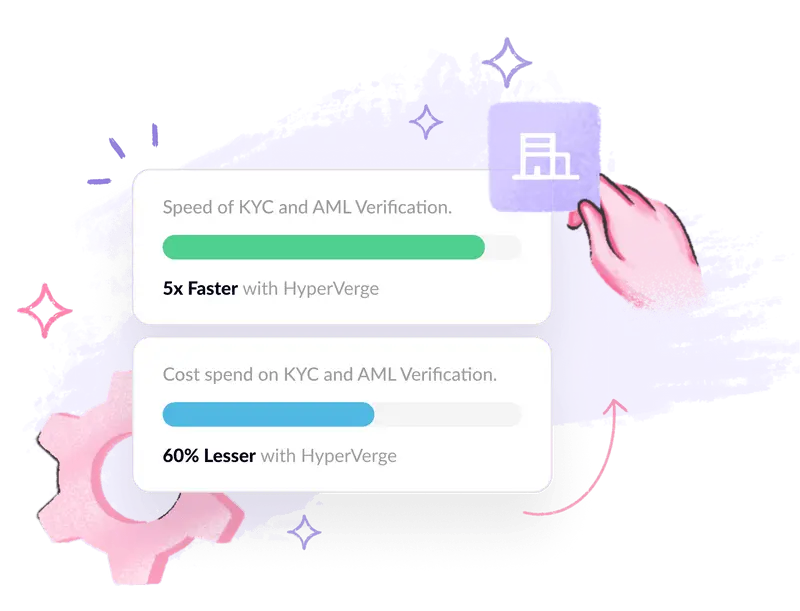

HyperVerge offer a comprehensive AML solution to automate and enhance multiple-sanction screening, ensuring companies stay compliant with regulatory requirements.

We help businesses make sure all customer details are accurate and complete. With our tools, businesses can quickly check and verify information, ensuring they meet CDD and EDD requirements easily. Our sanctions screening solutions offer accurate and up-to-date customer data for effective screening across multiple sanctioning bodies.

With access to reliable global sanctions lists and real-time monitoring, we minimize risks and enhance efficiency. We help companies handle alerts quickly with clear escalation procedures, improving their risk assessments and compliance efforts.

Sign up and try HyperVerge for free today.