As of 1st January 2023, all General and Health Insurance companies are required to do KYCs while issuing policies as mandated by the IRDAI. These include the use of Aadhaar-based KYC, Digital KYC, CKYC, and Video KYC for customer identification and verification. In addition, the IRDAI had established guidelines for Anti-Money Laundering and Counter Financing of Terrorism, which mandate that insurers must identify their customers and monitor all transactions to ensure compliance.

HyperVerge brought together CXOs from leading insurance companies, web aggregators, and insurance brokers to discuss their experiences post go-live to

- Understand the challenges companies are facing around drop-offs and conversions

- Identify ways to reduce drop-offs, working with partners and giving customers a seamless experience

Starting Jan 2023, the focus is moving to critical business metrics

- Till Dec 31, 2022, being able to go-live with a compliant KYC solution was the main focus for most of the companies

- The focus is now shifting towards business metrics such as completion rate, drop-off rate and automatic-approval rates, etc.

What are the important business metrics to track?

- Improvement in business metrics has a direct impact on the top-line of the company

- Completion rate = (Number of customers that completed KYC) / (Number of customers that started the KYC process)

- Drop-off rate = (Number of customers that dropped off) / (Number of customers that started the KYC process)

- Automated-approval rate = (Number of customers who were approved without manual intervention) / (Total customers who were approved)

- Many companies have now started discussions with other partners in the market to understand who can help them achieve the best business metrics across partners.

What are the benchmarks to aim for?

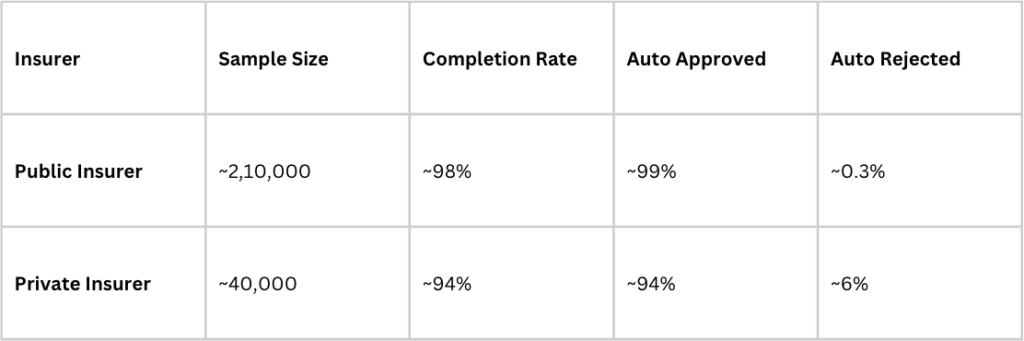

HyperVerge has partnered with 10+ General and Health insurers. Our team has achieved the following business metrics with 2 insurers (1 public, and 1 private) that we are keeping as benchmarks for all other insurers.

What are the main challenges shared by various participants?

One of the most common challenges across the board was drop-offs. Drop-offs are happening at different stages of the customer journey due to multiple reasons.

CKYC record mismatches

There are inconsistencies in the records stored in CERSAI, which do not match the information provided by the customer. Mismatches in customer details are becoming a reason for drop-offs.

ID card challenges

One of the largest motor insurance brokers in India faces a unique challenge. Some of the customers that they sell to are from very remote areas. Some of them do not have all the documents required during the process. Some of them carry only voter IDs. If we do not have the ability to process all the IDs that can be presented it leads to drop-offs.

Downtimes of CERSAI, and Digilocker

Companies are not getting responses from CERSAI and Digilocker during downtime. This is leading to drop-offs. Whenever there is a delay in OTP getting delivered some customers who might not have the time or patience may drop off.

Linking of Phone and Aadhaar

For many people, phone numbers and Aadhaar are not linked, they keep waiting on the Digilocker screen for OTP. This leads to drop-off.

Challenges with uploaded images and OCR

The quality of images being uploaded for OCR can be poor, which makes it difficult to read the information. Customers upload different orientations of the document, cropped versions, and sometimes customers upload wrong documents. It is a challenge to complete the KYC process if the data submitted is not good. This can lead to drop-off. Additionally reading local languages on ID cards is also a challenge.

How do we reduce drop-offs and increase conversions?

Different companies have adopted different strategies to tackle these challenges. Here are some interesting examples.

No CKYC, only Digital KYC

A large motor insurance broker that serves a significant rural population has chosen to not use CKYC. They are using only OVDs for KYCs and their primary preference of ID is Aadhaar as it is the largest available database and CKYC doesn’t have a large coverage in their target segment.

Only CKYC for better brand experience

Contrastingly, on the other hand, a large web aggregator is using only CKYC and no other form of KYC currently. Their team feels that the other forms of KYC create friction for the users. They want the experience on their platform to be seamless. They are willing to let go of customers who cannot do CKYC so that the overall brand and experience are not affected.

Starting the user journey with KYC

A large motor insurance broker finishes KYC at the very beginning of the customer journey instead of doing it before payment. They are seeing this performing better.

Common themes

Some common themes emerged as solutions to the problems the industry is facing

Addressing issues with OCR readability

- OCR readability is a problem that directly leads to drop-offs.

- The choice of OCR technology is very important to ensure a good customer experience and increase conversions.

- AI engines that ensure that the correct images are uploaded and in the right format (cropped image check, ID tampering check, image quality check, etc) right at the time of uploading images are important.

Ensuring API responses are quick

- In the policy buying journey of a customer, the number of screens is increasing and the lag time of API responses is leading to drop-offs.

- Companies have to ensure that with increasing complexity, the response time of APIs is fast to make the whole onboarding journey more efficient.

Educating customers about CKYC

- A lot of people don’t know that they have a CKYC number.

- If one has invested in the stock market or mutual funds that individual will most likely have a CKYC number.

- Ensuring customers know that they have a CKYC number can help reduce drop-offs.

- One large insurance web aggregator was initially seeing 80% of customers choosing the OVD flow and only 20% through CKYC.

- They realized that they had to educate customers about CKYC and after constantly educating customers, the numbers are now flipped with 80% of customers primarily choosing the CKYC flow first.

Choosing the primary form of identification depending on the target customer segment

- The choice between Aadhaar vs CKYC needs to be made after understanding the target customer segment.

- For example, one of the largest motor insurance brokers uses Aadhaar as the primary form of identification.

- As Aadhaar is the largest available database and CKYC doesn’t have a large coverage in their target segment.

Making the process as frictionless as possible for the customers

- Especially for motor insurance, customers don’t really care about picking a policy, they just want to get it over with as part of adhering to regulations.

- Focus has to be on reducing the number of clicks a customer has to do and the pages they have to view before buying a policy.

What has helped HyperVerge achieve high completion rates?

The following initiatives have contributed the most to achieving 98% and 94% conversion rates at 2 insurers.

- Seamless orchestration of different KYC options to increase conversions

- Highly reliable and accurate underlying KYC modules – OCR, DigiLocker, CKYC

- Health Check APIs to keep checking the uptime of DigiLocker, etc.

- Dedicated joint team working at calibrating journeys till we reach satisfactory business metrics

Need to collaborate

KYC is new to the insurance industry and the current guideline is IRDAI’s first draft. As the industry adopts and stabilizes, we can expect IRDAI to come out with revised guidelines, similar to how RBI, and SEBI constantly update guidelines for their regulated entities. All insurance companies and partners have to be ready for such changes.

All players in the industry have to collaborate to solve KYC challenges. By coming together to solve a common problem, companies can find solutions that benefit everyone.

FAQs

What modes of KYC are recommended for general and health insurance companies?

While implementing KYC, insurers have to ensure that they are compliant with IRDAI regulations while maximizing conversions and thereby deriving maximum ROI. Aadhaar-based KYC, Digital KYC, Video KYC, CKYC are all accepted forms of KYC. Insurers can choose any mode that suits the comfort of their end customers.

What are the advantages of stricter KYC/AML processes for non-life insurance companies in India?

Adhering to strict KYC processes helps reduce fraud and curb the illegal activity of money laundering and the financing of terrorist activities.